Credito 365 is one of the leading microfinance companies in Latin America, operating in the online lending segment. The brand focuses on fast decision-making and customer convenience. Intense competition and rising fraud levels in the region drive the company to seek a balance between borrower loyalty and robust protection against abuse.

Challenges in the Mexican Microfinance Landscape

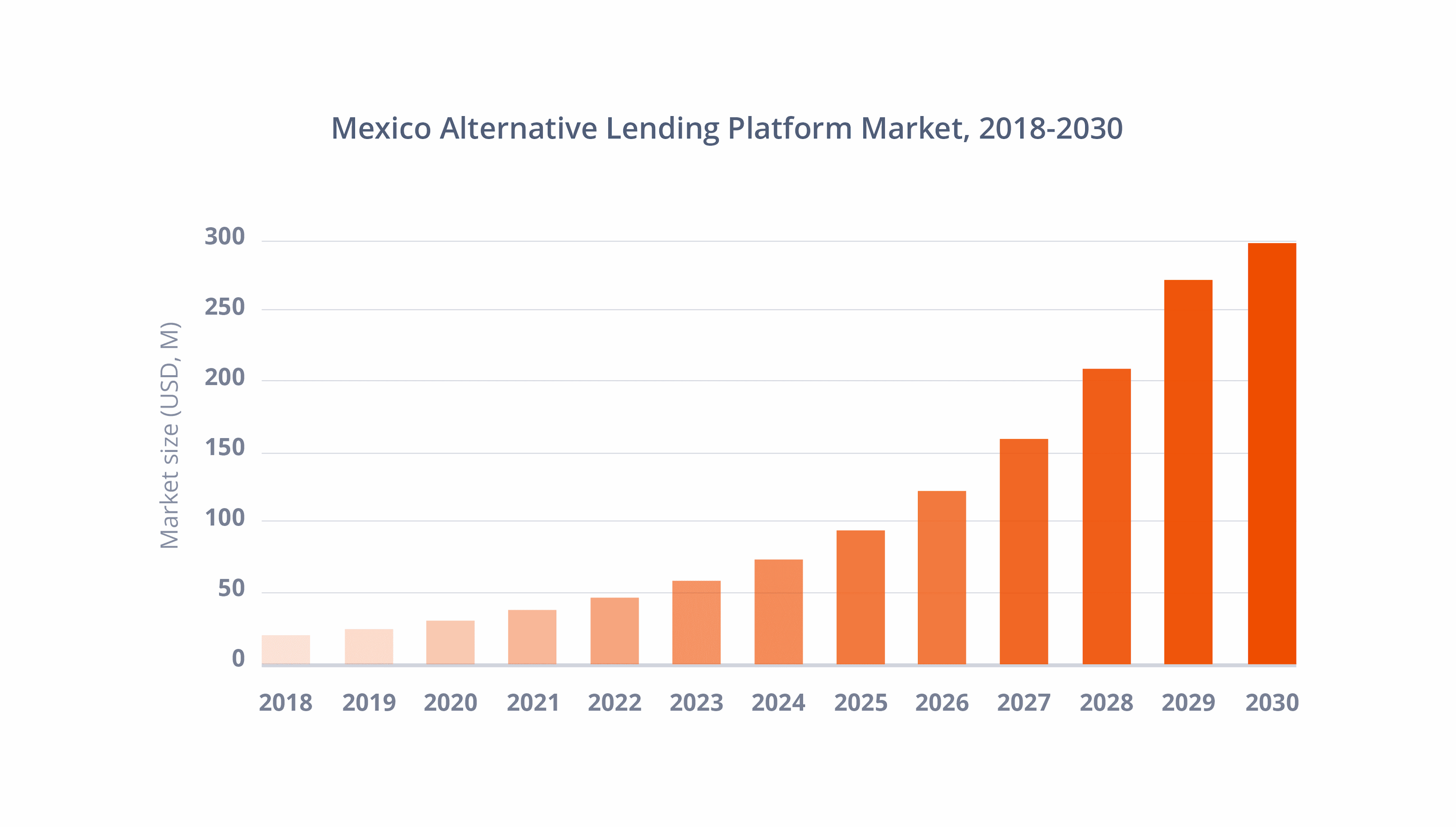

The Mexican digital microfinance market has shown rapid growth, driven by demand from younger consumers and underbanked populations. According to marketsresearch.com, the consumer lending market in Mexico reached $323.4 billion in 2024 and is projected to grow to $532.7 billion by 2033, with a compound annual growth rate (CAGR) of 5.2% between 2025 and 2033.

However, this expansion brings multiple challenges for risk and compliance teams:

- Fraud prevention in digital lending is becoming increasingly complex, with rising cases of identity fraud, synthetic identities, and device spoofing via emulators or virtual machines.

- Access to reliable external data is often costly and limited, especially for new market entrants.

- High customer acquisition cost as the leads are expensive and the incoming traffic is mostly of a low quality.

In such a landscape, it is critical for lenders to access alternative credit scoring methods that do not rely on personal or financial data, but still deliver significant predictive power to support scalable risk decisioning and fraud detection.

When a Device Says More Than it Seems

To strengthen its risk stack, Credito 365 integrated JuicyScore’s device intelligence technology into its underwriting process. This privacy-safe solution enables more accurate repeat borrower risk assessment and fraud signal detection for both new and returning users.

In particular, two categories of device-level variables have had a meaningful impact on portfolio quality:

- Software environment signals – including OS type, browser configuration, and signs of tampering or virtualization – help identify fraudulent loan applications attempting to bypass security checks.

- Hardware-based indicators, such as RAM specs and memory performance, add further depth to the risk profile and support fraud prevention analytics.

These signals help lenders see beyond the user interface, gaining real-time insight into the trustworthiness of the session, while maintaining full compliance with privacy-first data policies.

Business Impact for the Client

By adopting JuicyScore’s privacy-safe antifraud solution, Credito 365 was able to:

- Significantly improve credit scoring accuracy for repeat borrowers

- Lower the fraud rate

- Enhance customer segmentation based on risk signals from alternative data

- Build a more resilient and high-quality loan book without compromising speed or customer experience.

These outcomes enabled Credito 365 to strengthen its competitive position in the Mexican lending market, ensuring both sustainable growth and a more robust risk management framework in the face of rising fraud threats.

“With the rise of digital fraud, especially in repeat applications in Mexico, we needed a technology that could provide deeper transparency at the device level. Integrating JuicyScore allowed us to improve scoring accuracy, reduce risk, and make our decision-making process more resilient to fraud attacks.”

— Vladimir Rudiakov, CEO, Credito 365Key Outcomes