Practical Guide to India’s Final DPDPA Rules – And How JuicyScore Ensures Full Compliance

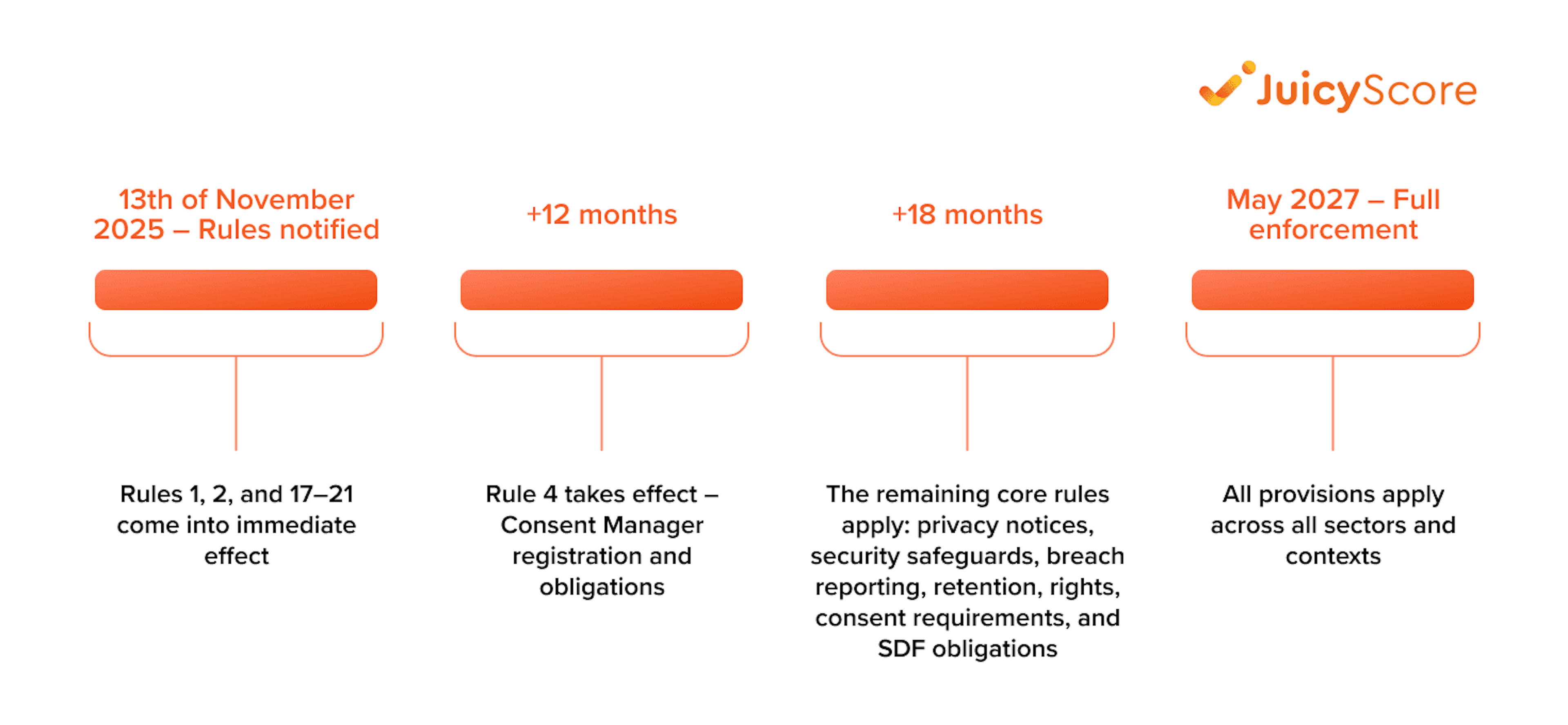

India’s Digital Personal Data Protection Act (DPDPA) has entered its implementation phase. With the publication of the Digital Personal Data Protection Rules, 2025 on 13th of November 2025, financial institutions, BNPL platforms, and digital lenders finally have a clear regulatory roadmap for compliance over the next 18 months.

These Final Rules define how organisations must handle consent, security safeguards, breach reporting, retention, and cross-border transfers. They also introduce obligations for Significant Data Fiduciaries (SDFs), shaping how large fintechs and digital-first businesses must govern data processing in India.

This guide summarises the key operational requirements and explains how JuicyScore’s zero-PII model ensures full alignment with India’s new data protection framework.

Organisations must provide transparent, easy-to-understand notices that include:

These requirements apply to apps, onboarding flows, and digital services.

For the processing of children’s data or processing by lawful guardians, consent must be verifiable. Organisations must ensure:

Data fiduciaries must implement:

Access logs must be retained for a minimum of one year.

In the event of a personal data breach, organisations must notify:

A detailed report must be submitted within 72 hours.

Data must be erased when the purpose is no longer served. The Rules require:

Organisations must ensure clear, accessible mechanisms for users to:

Websites and apps must clearly publish the relevant processes.

DPDPA introduces significant operational requirements for financial institutions and digital lenders.

JuicyScore’s risk-scoring architecture is inherently compliant because we do not process personal data at any stage. We analyse device behaviour and environment signals, not user identifiers.

We do not collect names, emails, phone numbers, financial identifiers or government-issued IDs.

Our models rely exclusively on non-PII metadata.

Because JuicyScore does not handle personal data:

This significantly reduces compliance burden and regulatory risk.

All data flows are encrypted, access-controlled and logged in line with Rule 6 standards.

Because no personal data is processed, international data flows remain fully compliant with Rule 15.

Read more Manish’s expert blog on how JuicyScore’s PII-free device intelligence models fit perfectly into India’s DPDP era.

India’s Final DPDPA Rules mark a significant shift in how financial institutions must structure their data governance practices. For lenders, BNPL providers, and digital onboarding platforms, compliance will require new flows, new controls, and new operational discipline.

JuicyScore helps organisations meet these expectations by providing a robust risk-detection layer that does not rely on personal data. Our device intelligence framework reduces regulatory exposure, simplifies compliance workflows, and supports secure, low-friction onboarding.

Prepare your organisation for DPDPA. Download the PDF guide DPDPA Rules 2025: Final Compliance Overview & Client Checklist.

Manish Thakwani shares expert insights on PII-free risk scoring in India’s DPDP era — why device intelligence is key to compliance, fraud prevention, and growth.

JuicyScore API 17 introduces 17 new variables, improved indexes, and a faster infrastructure to enhance fraud prevention, risk analysis, and client experience.

RBI is pushing beyond OTPs. Learn how risk-based authentication, device intelligence, and audit-ready evidence help banks and PAs comply by April 2026.

Get a live session with our specialist who will show how your business can detect fraud attempts in real time.

Learn how unique device fingerprints help you link returning users and separate real customers from fraudsters.

Get insights into the main fraud tactics targeting your market — and see how to block them.

Phone:+971 50 371 9151

Email:sales@juicyscore.ai

Our dedicated experts will reach out to you promptly