New Standard for Mobile Risk Assessment: JuicyScore IDX7

With the increase in mobile transactions, fraud detection is becoming an increasingly important issue for financial institutions. According to expert estimates, the global market for mobile applications used for financial services is estimated to be USD 146.65 billion in 2024 and is expected to reach USD 271.75 billion by 2029.

Businesses need intelligent tools that can distinguish between honest users and fraudsters. One such tool is IDX7 Device Applications Quality, an index from JuicyScore, specifically designed for use on clients’ mobile platforms via integration of our SDK. IDX7 provides a powerful aggregated evaluation of the applicant device’s software, helping businesses effectively detect fraudulent risks and patterns of high-risk behavior.

IDX7 is an advanced indicator for detecting signs of software-related fraud. Unlike traditional risk assessment models, which often rely on static user data, IDX7 employs a dynamic approach by analyzing data on user interactions with the device, its configuration, and the installed applications to identify potential threats.

This variable is available only for mobile SDKs and represents an aggregated assessment of the applicant’s installed applications. It is recommended for detecting fraud risk, high credit risk, and the risk of social default. To assess this parameter, it is necessary to configure the collection of the final list of applications during SDK integration.

IDX7 analyzes various attributes of a mobile device, including:

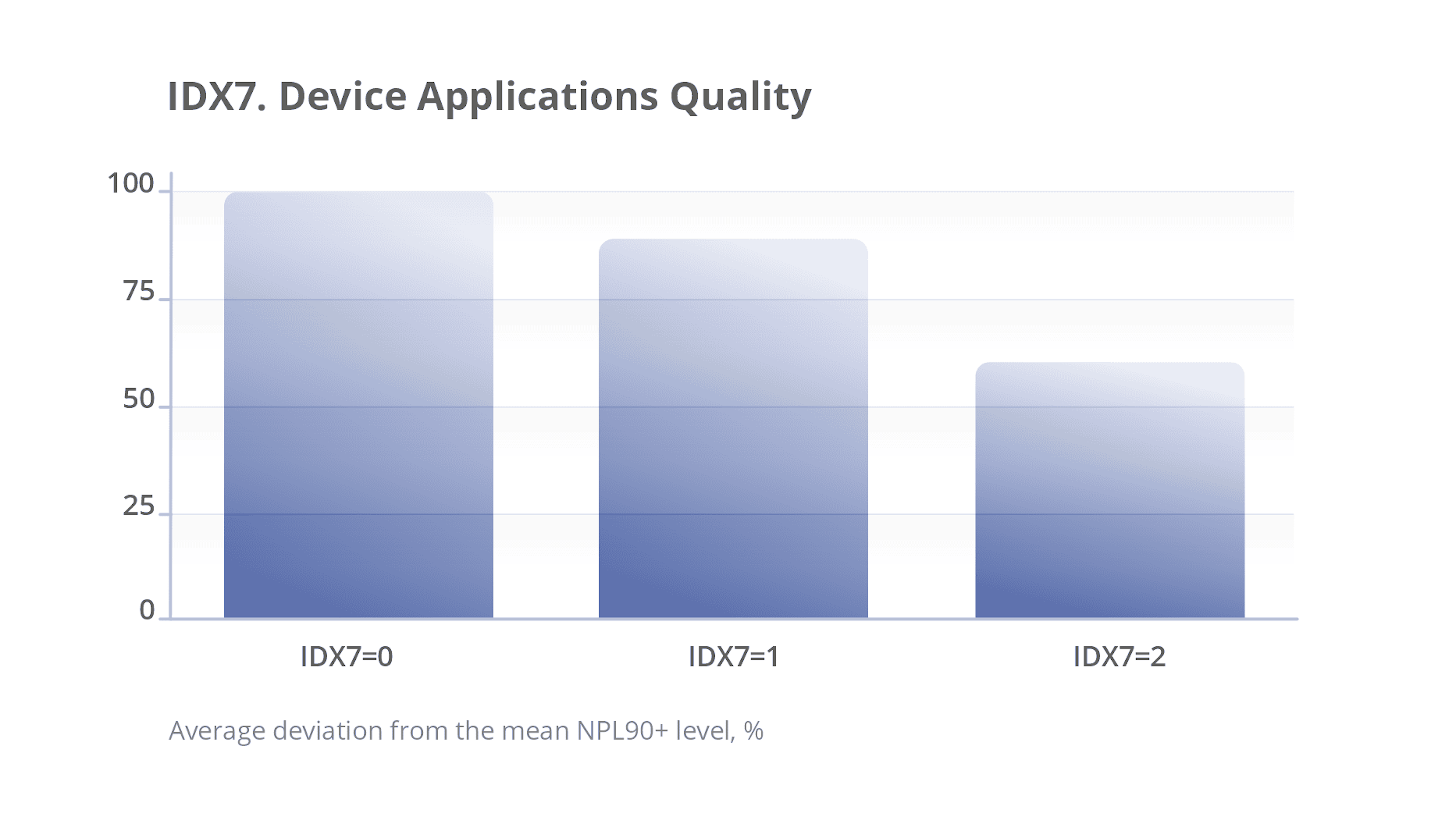

Studies show that a high IDX7 index correlates with an increased likelihood of fraud. Below is a chart of risk reduction depending on the index values:

Fraudsters use increasingly sophisticated methods, such as multi-accounts, identity forgery, and synthetic fraud, to bypass traditional verification methods. IDX7 enhances fraud detection models by:

The application of IDX7 is particularly relevant for developing countries, where the level of fraud is higher and traditional risk assessment methods are less effective.

As fraudsters continue to refine their schemes, businesses need smarter tools for protection. DX7 Device Applications Quality is part of a broader strategy to strengthen fraud prevention by utilizing AI-driven risk assessment. By applying this technology, companies can ensure safer transactions, an improved customer experience, and reduced financial losses.

Modern web applications use dynamic interfaces based on the DOM (Document Object Model).

API 16: +50 IV% and +25% Gini — Your Key to Business Safety

An expert article by JuicyScore's Business Development Manager, featuring first-hand insights on fintech expansion in Latin America. Discover how digital signals and device intelligence are redefining risk assessment in high-fraud environments.

Get a live session with our specialist who will show how your business can detect fraud attempts in real time.

Learn how unique device fingerprints help you link returning users and separate real customers from fraudsters.

Get insights into the main fraud tactics targeting your market — and see how to block them.

Phone:+971 50 371 9151

Email:sales@juicyscore.ai

Our dedicated experts will reach out to you promptly